Why Financial Services are Banking on AI Business Solutions

Financial services aren’t holding back when it comes to tech investment. In 2024 alone, the sector poured roughly US$434 billion into IT. And that number isn’t slowing down any time soon.

In fact, spending is projected to jump 7.8% in 2025, reaching around US$760 billion. Gartner further predicts a steady rise of 8.7% CAGR through 2029.

So, what’s driving this surge? A wave of transformative technologies such as blockchain, cloud computing, and even the emerging Banking of Things (BoT). But if there’s one technology that has truly captured the spotlight across financial institutions, it’s artificial intelligence.

And the numbers prove this. According to Statista, financial services firms spent $35 billion on AI business solutions. Come 2027, investments are projected to reach $97 billion.

💡Still unsure about the power AI has to offer your apps? AI has stirred an impressive revolution when it comes to developing custom apps and you can’t afford to be lagging behind. Especially with how tough competition is.

The Benefits of Custom AI Business Solutions

AI solutions have a lot to offer the financial services sector depending on how creatively they’re used. Here are seven main benefits that reel in most firms.

1) Enhanced Customer Experience and Personalization

Custom AI solutions enable financial institutions to deliver highly personalized services based on individual customer behavior, preferences, and financial history.

So, instead of offering generic recommendations, AI models can suggest tailored investment options, saving plans, or credit products.

For example, a bank can use a finance AI chatbot to answer basic customer queries as well as offer deeper, personalized guidance.

This guidance is based on transaction histories, monthly spending habits, income inflow, recurring bills, and savings goals. Some chatbots can even recommend customized budgeting plans, highlight overspending risks, and suggest investment products tailored to a customer’s financial profile.

Some chatbots can even be programmed to recommend specific actions such as choosing a different credit card with lower fees. Over time, the AI continues to learn from behavior patterns, making its recommendations more accurate and aligned with long-term financial goals.

In addition to making clients happy, banks get to offer a more proactive experience where customers receive valuable financial advice instantly. And without needing a human advisor.

2) Improved Fraud Detection and Risk Management

Despite gaining a bad reputation when used in criminal acts, AI is equally (if not more) helpful preventing them. In fact, over 50% of organizations use the technology to –

- Fraud and Anomaly Detection – AI identifies unusual patterns and suspicious transactions by continuously analyzing customer behavior, transaction history, and system activity. Machine learning models also detect anomalies in real time, reducing false alarms while improving accuracy.

- Potential Fraud Prevention – AI doesn’t just react to fraud; it predicts it. By assessing past incidents, user behavior, and external threat data, AI models forecast potential fraud attempts before they occur. This enables proactive measures such as transaction blocks or customer alerts to prevent financial losses and unauthorized access.

- Risk Scoring – Some AI business solutions can assign risk scores to users, transactions, accounts, and loans using large datasets, including behavioral patterns, income history, spending habits, and credit profiles. These help financial companies make safer decisions, approve loans responsibly, and identify high-risk activities instantly. As a result, they can avoid financial loss or regulatory penalties.

- Network Analysis – With AI, network analysis is easier. Systems can uncover hidden relationships between entities and detect sophisticated fraud rings, money laundering networks, etc. By mapping connections and transactional flows, AI reveals complex criminal activities that are often missed by rule-based monitoring systems.

3) Automated Compliance Monitoring and Reporting

Regulatory compliance is one of the most demanding, expensive, and high-risk responsibilities in the financial services sector. With constant changes to regulations such as Anti-Money Laundering (AML) and Basel norms, manual monitoring isn’t sufficient.

Custom AI-powered compliance solutions can easily automate the entire process. These systems continuously scan transactions, communication logs, identity documents, and audit trails to ensure that every action aligns with regulatory standards.

Moreover, Natural Language Processing (NLP) models can be used to interpret legal variations and automatically update internal compliance rules.

There’s also the option of generating audit-ready reports with AI. Doing so delivers several benefits including reducing human error, improving transparency, and preventing significant fines or reputational damage.

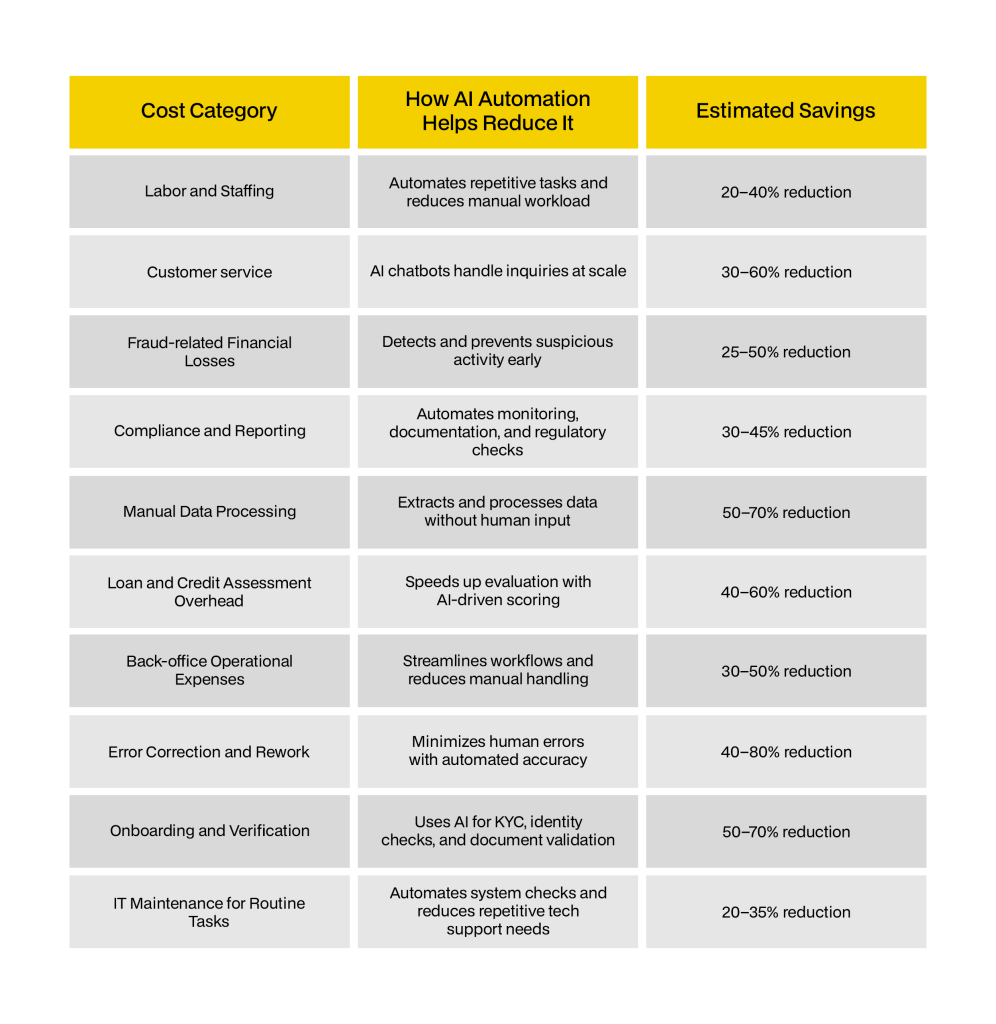

4) Cost Reductions Through Process Automation

AI business solutions can effectively reduce operational costs by automating repetitive and labor-intensive tasks. Insurance companies, for instance, use AI-powered optical character recognition (OCR) to process claim documents automatically.

In addition to allowing businesses to allocate employees to higher-value tasks, taking such measures minimizes manual review time and reduces operational costs.

5) Predictive Modeling for Market Trends

Predictive modeling uses AI and machine learning to analyze massive volumes of data such as historical market data and real-time trading activity to forecast future market movements.

What makes this stand out from traditional statistical models is that AI systems continuously learn from new data and adapt to changing market conditions.

Predictive models can be great for:

- Investments – They help identify opportunities, detect early signs of market volatility, and optimize portfolio allocation.

- Asset Management – Asset managers get to anticipate interest rate shifts, sector rotations, liquidity risks, and asset price movements with greater precision.

- Risk Management – AI business solutions with predictive analytics can be used to stress-test portfolios against future scenarios and identify exposures before losses occur.

6) Increased Operational Efficiency and Accuracy

AI-powered automation transforms financial operations by eliminating manual processes and reducing processing times. This, in turn, leads to shorter turnaround times and improved service delivery.

Applying machine learning to data validation and decision-making further improve accuracy in risk assessments, compliance checks, and financial reporting. And as AI systems continuously learn from historical data, they can easily refine outputs to strengthen operational performance and enhance customer trust and regulatory confidence.

AI-powered automation also significantly reduces human error by applying consistent rules, intelligent validation, and real-time anomaly detection across financial workflows. This leads to more accurate data handling, improved regulatory compliance, and fewer costly rework cycles.

At the same time, automation allows teams to shift focus from repetitive administrative tasks to higher-value activities such as customer advisory, risk analysis, and strategic planning. This drives better resource utilization and overall operational performance.

7) Strengthened Cybersecurity and Threat Detection

Cyber threats to financial institutions have grown more sophisticated, frequent, and costly. That’s why they need all the help they can get to detect threats in real time. Something AI business solutions can easily help with.

Unlike traditional rule-based security systems, AI models adapt to evolving attack techniques, enabling faster identification of zero-day threats, insider risks, phishing attempts, account takeovers, and malware intrusions.

Machine learning algorithms analyze billions of data points across devices, applications, and transaction flows to establish normal behavior baselines. So, when anomalies like unusual login locations occur, AI systems immediately flag or block the activity before damage occurs. This significantly reduces breach response times and minimizes financial and reputational losses.

AI also enhances predictive threat detection by identifying early warning signals of cyberattacks. Therefore, institutions get to act proactively rather than reactively.

Complementing these are automated response mechanisms that isolate affected systems, reset credentials, and notify security teams instantly. Not only do these reduce reliance on manual intervention, but they also improve operational resilience.

💡Make sure you’re well informed about AI business app development before taking the plunge. A strong foundation helps you choose the right use cases, set realistic expectations, and ensure your investment delivers measurable business value rather than experimental results. Especially read on these tips before contacting artificial intelligence application development services.

Examples of Artificial Intelligence Business Solutions

There are many real-life examples of AI solutions used in the financial services sector. Below are four solutions that have had ample coverage.

1) Visa Account Attack Intelligence (VAAI)

Visa Account Attack Intelligence (VAAI) is an AI-powered fraud prevention solution designed to detect and stop large-scale credential stuffing and account takeover attacks targeting merchant and financial institution login systems.

It analyzes global transaction and login behavior patterns across Visa’s network in real time to identify coordinated attack activity before fraud occurs, allowing businesses to block malicious login attempts while minimizing friction for legitimate users.

2) Bank of America’s Erica

One of the popular real-life AI business solutions, Erica is Bank of America’s AI-powered virtual financial assistant. It helps customers manage their banking through voice and text interactions.

It further provides services such as checking balances, paying bills, monitoring subscriptions, receiving fraud alerts, and offering personalized financial insights. This makes everyday banking faster, simpler, and more personalized for millions of customers.

3) J JPMorgan Chase’s OmniAi

JPMorgan Chase Omni AI is the bank’s enterprise-wide artificial intelligence and machine learning platform. It’s designed to embed AI across operations including risk management, fraud detection, trading, and compliance.

It also enables large-scale data modeling, predictive analytics, and intelligent automation. As a result, it improves decision-making, operational efficiency, and customer experiences across the organization.

4) HSBC’s Dynamic Risk Assessment (DRA)

HSBC Dynamic Risk Assessment (DRA) is an AI-driven fraud and risk management system that evaluates transactions in real time by analyzing customer behavior, transaction patterns, device data, and contextual signals.

It dynamically adjusts risk scores as activity occurs, enabling HSBC to detect fraud earlier and reduce false positives. As a result, it delivers stronger customer protection while maintaining smooth digital banking experiences.

Ready for the Age of AI for Business Development?

With our expertise in both FinTech and AI, DPL is ready to bring your next set of AI business solutions to the light. Here’s an example from our pre-AI days that showcases one of our experiences in this sector.

Let us know how we can help in the form below.